Pricing MCU’s features

31

Aug

2011

One way to alleviate the pain of comparing value is to model the price of each major feature and use it to map each feature difference into a price difference.

Last time, one of the major differences between the 2 competitors was USB. So let’s look at USB and try to extract its price, or rather its differential price. The idea is to look at pairs of products that are very close (ideally identical) in features with the exception of the feature we want to price.

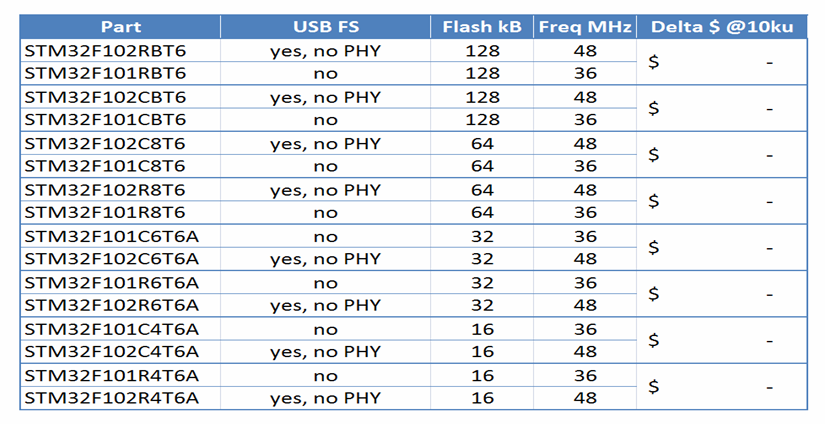

In the case of ST, if we look at the STM32F family and his hundreds of parts, it is no simple task to find pairs that would satisfy our requirements. With our dashboard however, we quickly found:

1) there is no identical USB/non-USB pairs

2) there are a number of pairs that have one feature altered in addition to the USB

3) the pairs identified in #2 have the SAME price

In the case of STM32F, it looks like a feature was traded for another i.e. for our particular case, USB 2.0 Full Speed vs. 12 MHz of the processor speed.

See the table below.

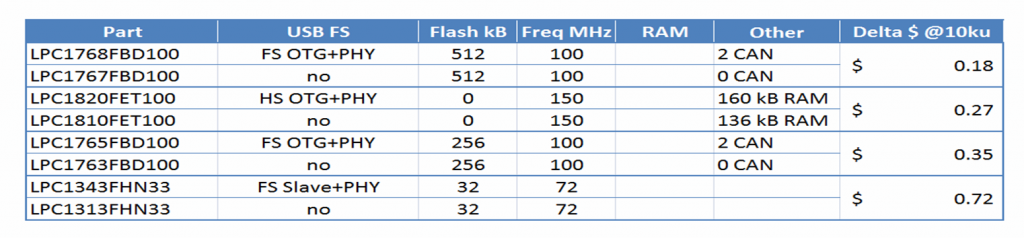

Now, let’s check on NXP’s side. While there is no pricing available on NXP’s site, there are plenty of other channels that sell NXP’s parts. We have to be aware this add another dimension of noise to the analysis, but we believe nonetheless it provides some insights. Again, with the dashboard we quickly narrow down to a few parts of interest and this time, there are true “siblings” found in the NXP Cortex-M portfolio.

Here is the list:

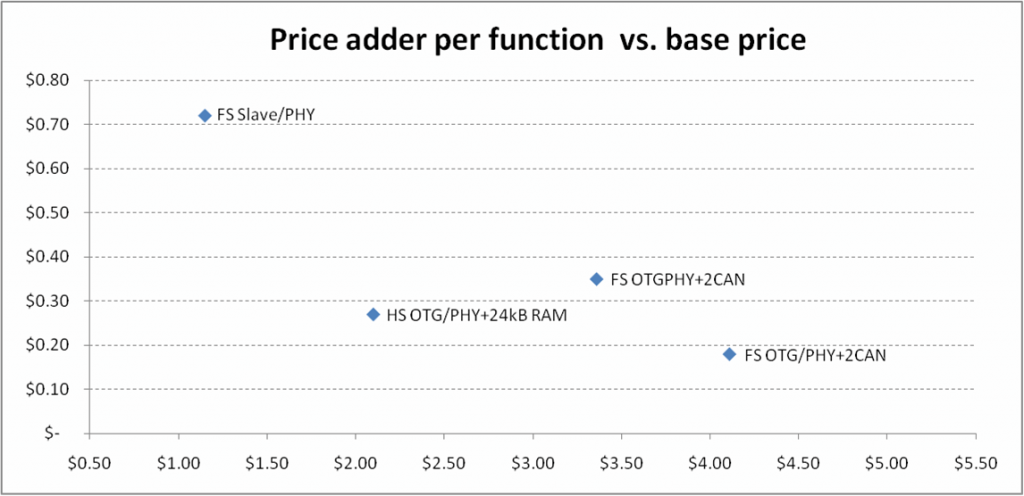

To have a better view of the incremental price for USB at NXP, let’s plot the base price (part without USB) vs. the incremental price to get to USB. We are showing the type of USB as well as other functions that were added with USB.

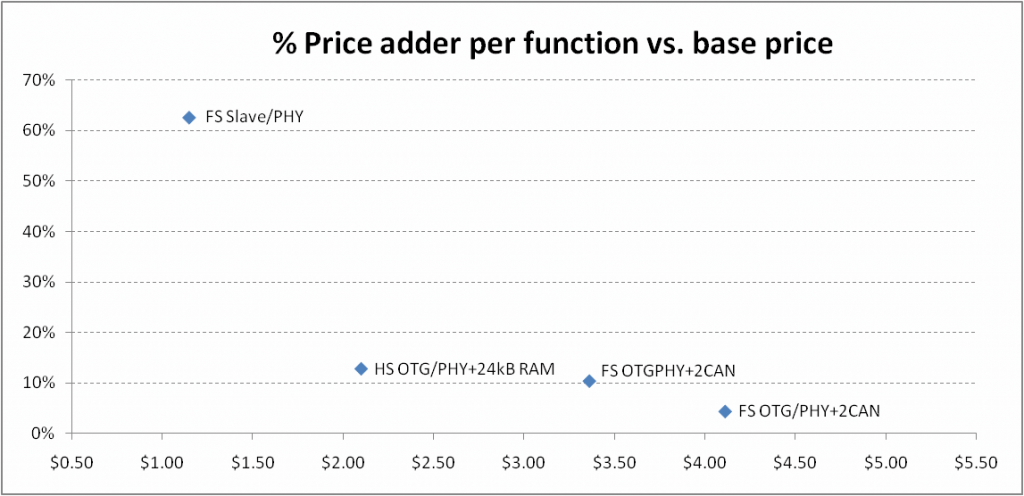

Now if we go one step further and look at the relative price increase for the USB function with respect to the base price, we see even more dramatic disparities.

There are a couple of comments we can make when looking at these charts:

1) The incremental price for the USB function is not constant over the price segments we analyzed. If the parts are manufactured in the same process, i.e. the cost/mm2 is similar, the value of the function is much higher in low cost products, (one could say it is rare in the low end) while customer will expect to take USB for granted in the higher end segment.

2) USB can command a premium of 60% to the base price at the low end.

3) Features can be traded e.g. 12 MHZ for a USB Slave.

Caveats…

Although, we could elaborate on more theories to explain the trend, we will work on getting additional data on the topic to identify stronger trends. With only 4 noisy samples in our set, we need to get some more data.

Also, with the simple equation that ST showed us in their STM32F101 and 102 families i.e. price(12 MHz) = price(USB FS), we have another hint at how to price MHz increments.

Stay tuned…

| Sign up for our newsletter |